Raising Capital from Angel Investors

02 Apr 2013, Posted by in Venture CapitalIf you’re like most people looking to raise money, you’re looking to determine the right fit and best timing — and the landscape is confusing. There are so many options, and you don’t have time to learn all the nuances of who to target and when.

In David Silvers’ book, Smart Start-Ups, he makes the path a whole lot more clear by sharing his insight over the past 40 years investing in, and arranging financing for start-up companies. Below is an excerpt from his book.

Angel investors are wealthy individuals, many of them former entrepreneurs, who love the chase. Sure, they want to make a terrific return on their investment, but they want to advise the entrepreneurs, whom they back with capital, push-up toll gates at hard to contact institutions corporations, and use gold Rolodexes to introduce the entrepreneurs to important contacts. By being useful to the companies that they invest in, the angels stay in the game, participate in the chase and cooperate with their co-investors in conference calls with the entrepreneurial management team.

I have managed a group of angel investors name Santa Fe Capital Group for more than 20 years and we’ve had a wonderful time working with entrepreneurs all over the world, fueling their dream machines. Many of the insights I have learned in my angel investing work have come from the entrepreneurs that the group has backed.

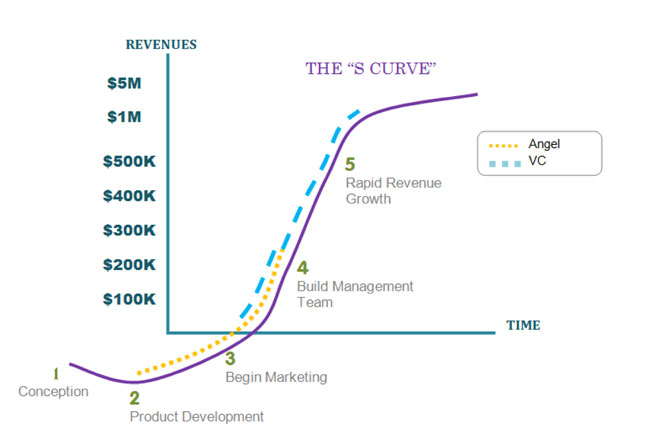

There are five stages in the growth of an entrepreneurial company. Angel investors generally invest at stage 2, after the new product or service has been conceived. See figure below.

Angel Investors Attempt to Advert Risk

There are typically five risks in a start-up or early-stage company that correspond to the five stages of development depicted above. Angel investors typically accept risks two through four. It is up to venture capitalist to accept no more than the last three of these risks, and the two that venture capitalist can control most effectively are the third and fourth: marketing and management. The five risks are:

- The conception risk: can we develop the market?

- The development risk: if we can develop it, can we produce it?

- The marketing risk: if we can make it, can we sell it?

- The management risk: if we can sell it, can we sell it at a profit?

- The growth risk: if we can manage the company, can we grow it?

The acceptable risks are marketing, management and growth because they are the most controllable. The conception risk is borne by the entrepreneurs and funded with their savings and family’s and friends’ capital. Angel investors accept four risks, and mitigate these risks by providing advice and guidance.

Excerpted from SMART START-UPS.

“David Silver’s genius level intuition-in his book “The Social Network Business plan” inspired me, more than any other book, as an entrepreneur!” Jim Nico, CEO/Founder/SNi